Payroll

Overview

Here you can manage your employees’ salary and all the other related costs.

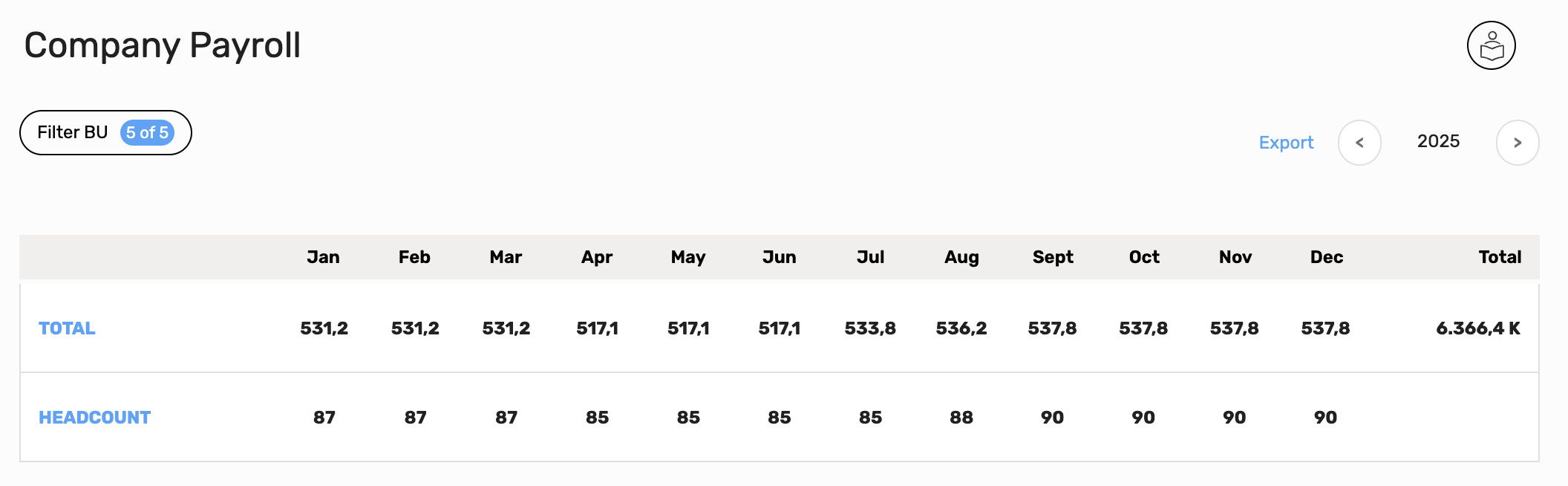

Totals

First thing that you see is a table which shows, by month and for the selected year, the company’s headcount and the sum of costs related to payroll.

The sum of costs are displayed in the Total row, they’re a combination of costs coming from placeholders, employees and adjustments.

The Headcount shows the amount of employees and placeholders with costs that impact on the company for the selected year.

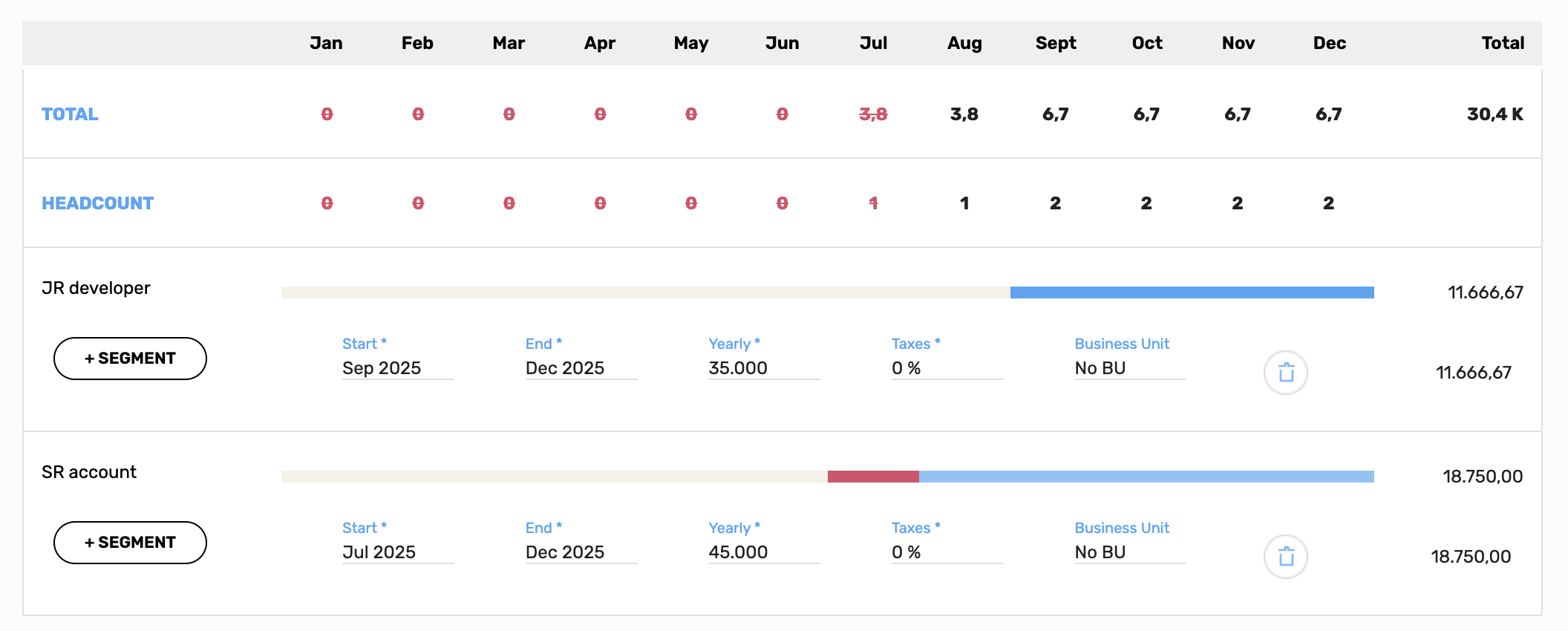

Placeholders

Here you can list all the employees you plan to hire in the future. Are you thinking about a new business analyst? Create a new placeholder and type in what you think the salary, taxes and duration could be. As soon as you stop typing you will see the updated totals and this can help you appreciate how the new figure will impact your business, just add new fake salaries and see if your revenues are still healthy.

Monthly values in the past are highlighted to remind you that a placeholder is not taken into account for totals calculations: a placeholder is a plan and a plan in the past makes no sense.

Note

Each placeholder has at least a segment, if you delete the last segment the relative placeholder will be deleted.

It is not possible to save a new segment until you fill all the required fields.

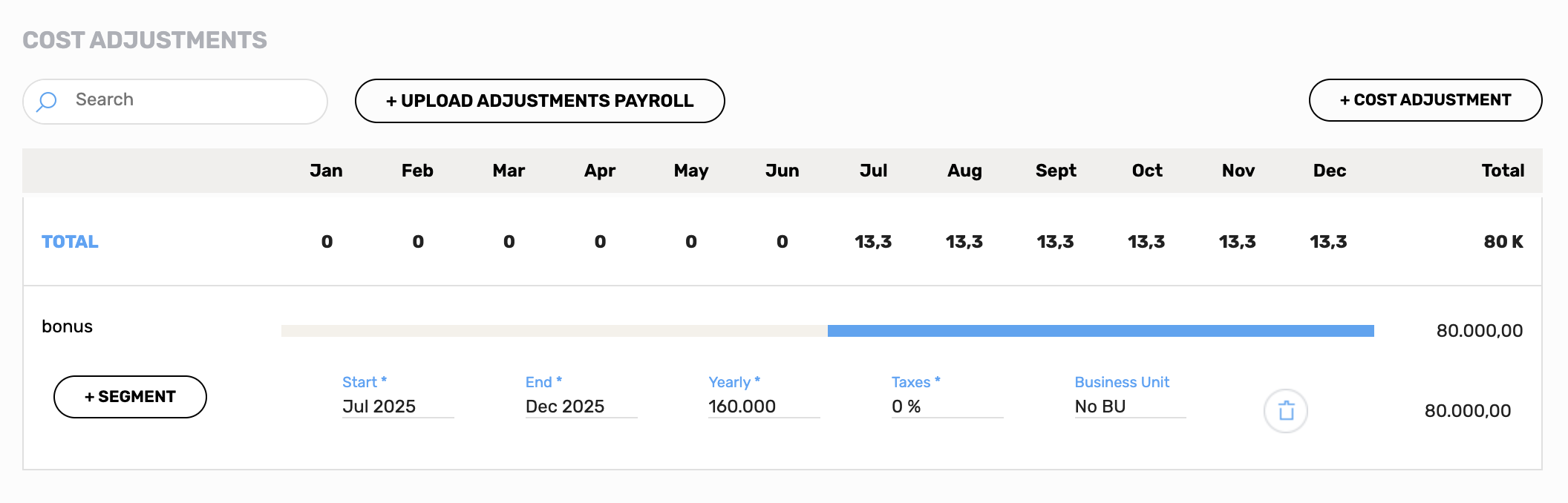

Cost adjustments

Here you can manage all the employees’ related expenses that are not directly connected to a particular employee or placeholder. For example, this is the right place to see how salary bonuses can impact your company.

There’s no headcount here because we’re talking about costs, not people.

Note

Each cost adjustment has at least a segment, if you delete the last segment the relative placeholder will be deleted.

It is not possible to save a new segment until you fill all the required fields.

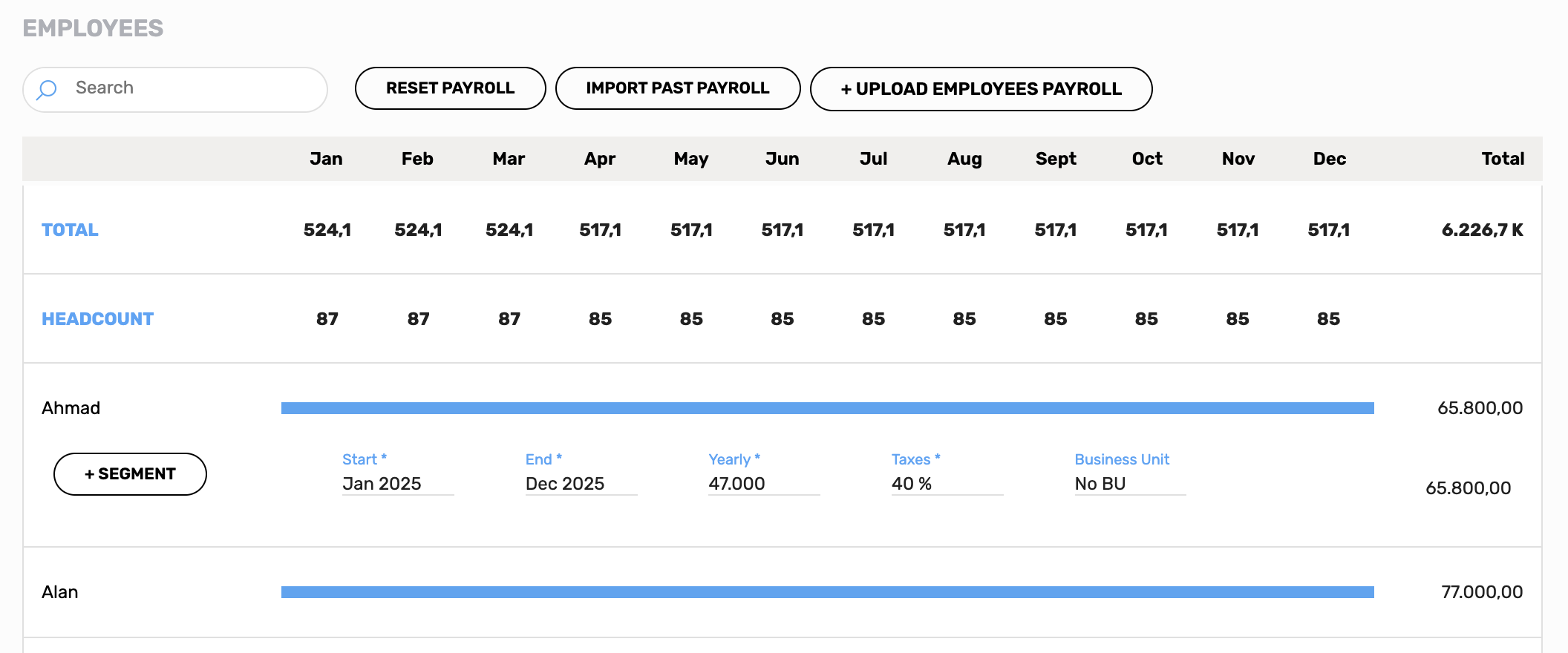

Employees

Here’s the employees’ salary for the current year.

Each Employee has at least a segment which represents a work contract between that employee and the company. Every segment has:

- Start month

- End month

- Gross monthly salary

- Taxes

- Business Unit (Available only if the module Business Unit is enabled)

You can access the segments for a specific employee just by clicking on the employee’s row. Each time you edit a list of the segments, this influences the employee’s salary distribution: a line where all segments are visually represented, allowing you to quickly understand how many times the salary of an employee is changed during the year.

Use the Reset payroll button take all payroll’s rows down to zero, once done you can use the Import payroll button to copy all the payroll’s rows from the previous year.

Note

It is not possible to delete the last segment of an Employee.

It is not possible to save a new segment until you fill all the required fields.

Import Placeholder Payroll

You can import a set of segments for your payrolls, just press on + Upload Placeholder Payroll, download the provided excel template, edit it as you like and then load it pressing on Upload and then on Import.

Import Cost Adjustments Payroll

You can do here the same thing like the placeholders to import a set of cost adjustments for your payrolls, just press on + Upload Adjustments Payroll, download the provided excel template, edit it as you like and then load it pressing on Upload and then on Import.

Import Employee Payroll

Here you can perform 3 actions:

- Reset the payroll, explained in a previous point, but basically it deletes the all the segments.

- Import past payroll: import the payrolls for the previous year to the current.

- Upload employees payroll: using a custom template you can define as many segments you want for each employee.

How to customize your import template file

Below you can find an explanation for each column of the import template file.

- employee_email: (this column appears only inside the employee payroll import template) insert here the email corresponding to the employee you want to create the new segment

- year: provide the year for the segment

- cost: insert here the cost

- taxes: insert here the percentage for the segment taxes

- from_month: fill with the starting month for the range of the segment (from 1 to 12)

- to_month: insert the ending month for the range of the segment (from 1 to 12), beware that this value must be major than from_month

- business_unit: if your company uses business units, insert here the name to assign one to the segment, or leave blank.

- label (this column appears only inside the placeholders and cost adjustments payroll import template) insert here a label for the row you’re going to create, it’s possibile also to leave it blank.